Choosing the right life insurance policy can feel overwhelming, especially with two common options: term life insurance and whole life insurance. While both offer financial protection, the differences in coverage, cost, and benefits mean that each type suits different needs and situations. Whether you’re considering protecting your family, planning for retirement, or investing in your future, understanding how to choose between term and whole life insurance is crucial to making an informed decision.

Understanding Life Insurance

Life insurance is a contract between you and an insurance company that ensures a payout to beneficiaries in the event of your death. It’s a way to provide financial security for your loved ones, covering costs such as mortgages, education, and even funeral expenses. The two main types of life insurance — term and whole life — come with distinct features, benefits, and limitations.

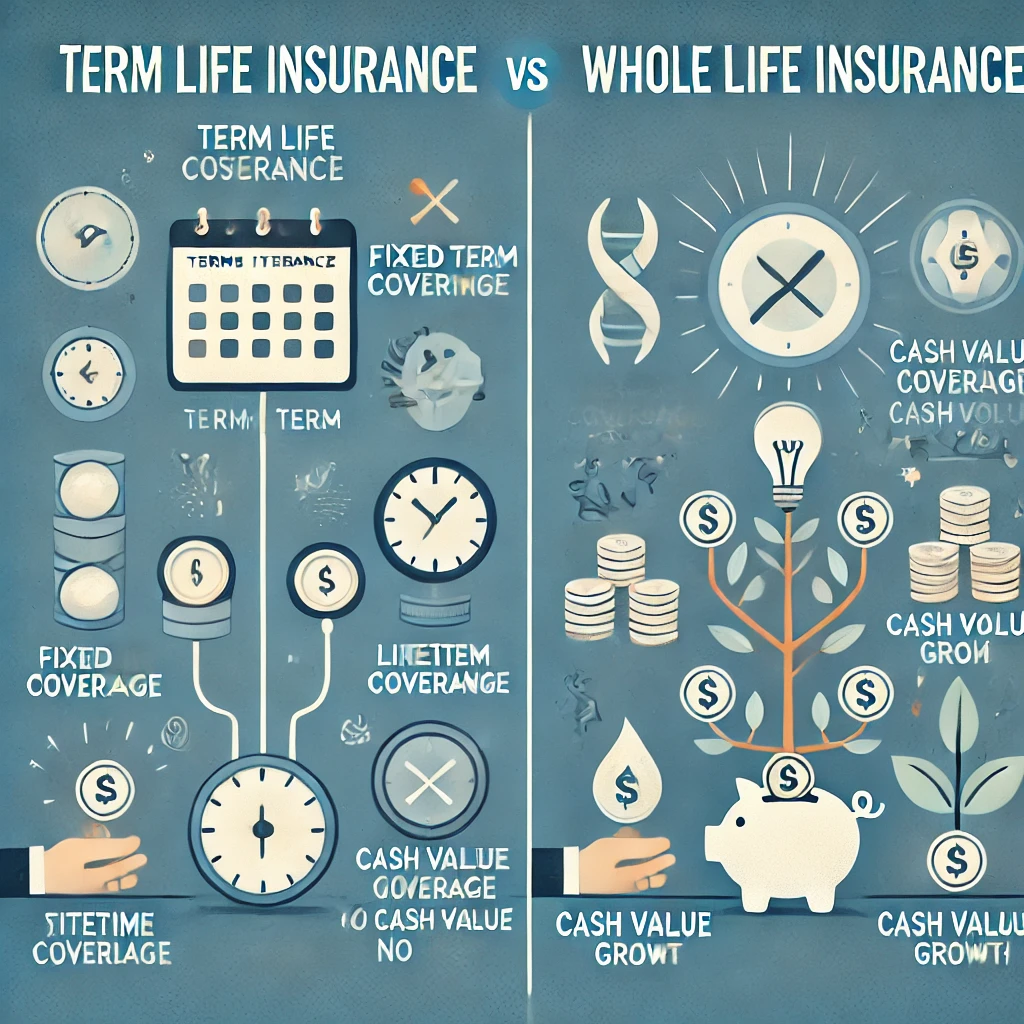

Term Life Insurance

Term life insurance is a straightforward, affordable option designed to cover you for a specific period, typically ranging from 10 to 30 years. If you die within this term, your beneficiaries receive a death benefit. However, if the term expires before your death, the policy simply ends without any payout. This type of insurance is ideal for individuals who need coverage during key periods, such as when they’re paying off a mortgage or raising children.

Key Features of Term Life Insurance

- Temporary Coverage: Provides protection for a set period.

- Affordable Premiums: Often cheaper than whole life insurance, especially for younger individuals.

- No Cash Value: Unlike whole life insurance, there’s no savings or investment component.

- Renewability: Many policies offer the option to renew at the end of the term, though at a higher premium.

Who Should Consider Term Insurance?

If you’re seeking affordable life insurance for a specific time frame — say, until your children finish college or your mortgage is paid off — term life insurance might be the best option. It’s perfect for those focused on affordability and immediate financial protection without long-term investment or savings goals.

Whole Life Insurance

Whole life insurance provides lifelong coverage, as long as premiums are paid. It also includes a cash value component that grows over time, which you can borrow against or withdraw under certain conditions. This type of insurance is more expensive than term insurance but offers the added benefit of accumulating savings.

Key Features of Whole Life Insurance

- Lifelong Protection: Coverage lasts for your entire life, as long as premiums are kept up to date.

- Cash Value Accumulation: A portion of your premium goes into a savings component, which grows tax-deferred.

- Fixed Premiums: The premiums generally remain constant throughout the policyholder’s life.

- Dividends: Some whole life policies pay dividends, which can be reinvested into the policy or taken as cash.

Who Should Consider Whole Life Insurance?

Whole life insurance is ideal for those looking to build a financial legacy. It suits individuals with long-term financial needs, such as estate planning or leaving an inheritance. It also works for people who appreciate the forced savings component and don’t mind higher premiums in exchange for permanent coverage and wealth-building opportunities.

Comparing Term and Whole Life Insurance

When deciding between term and whole life insurance, it’s essential to compare the core differences. Both offer valuable protection, but their costs, durations, and benefits vary.

Premium Differences

One of the most noticeable differences between term and whole life insurance is the cost of premiums. Term life insurance tends to be significantly more affordable, especially for younger individuals, because it provides coverage for a limited time. Whole life insurance, on the other hand, is more expensive due to its cash value component and lifelong coverage.

Duration of Coverage

Term life insurance only lasts for a set period, while whole life insurance provides lifetime coverage. If you want protection that won’t expire, whole life is the better choice. However, if you’re primarily interested in protecting your family during key financial obligations, term life may suffice.

Cash Value and Savings Component

Whole life insurance offers a cash value component that grows over time. You can borrow against this amount or use it for retirement, making whole life insurance both a protection plan and a savings tool. Term life insurance doesn’t offer this benefit, so it’s focused purely on financial protection, not savings or investment.

Financial Considerations

Your financial situation plays a significant role in choosing between term and whole life insurance. If you have a tight budget and are primarily concerned about covering specific financial obligations like a mortgage or college tuition, term life insurance may be the most cost-effective option. On the other hand, if you can afford higher premiums and want to build long-term wealth, whole life insurance could be the better choice.

Affordability

For most people, the affordability of term life insurance makes it an attractive option. The lower premiums mean you can get a substantial amount of coverage for a lower monthly cost. Whole life insurance, while more expensive, can be seen as a long-term financial commitment that contributes to savings and wealth-building goals.

Tax Implications

Another key consideration is the tax benefits of whole life insurance. The cash value grows on a tax-deferred basis, and the death benefit is typically paid out tax-free to beneficiaries. Term life doesn’t offer this investment aspect, but its death benefit is also usually tax-free.

Pros and Cons of Term Life Insurance

Like all financial products, term life insurance has its advantages and disadvantages.

Benefits of Term Insurance

- Lower Premiums: Generally more affordable, making it accessible to most people.

- Simple to Understand: With no cash value or investment component, it’s a straightforward insurance product.

- Flexible Terms: You can choose the term length that fits your needs.

Drawbacks of Term Insurance

- No Savings Component: There’s no opportunity to build cash value or savings.

- Coverage Ends: Once the term is over, the coverage ends unless you renew, often at higher rates.

You can also read; How to Get the Best Value from Your Renters Insurance Policy

Pros and Cons of Whole Life Insurance

Whole life insurance also has its share of pros and cons.

Benefits of Whole Life Insurance

- Lifelong Coverage: Offers permanent protection as long as you pay the premiums.

- Cash Value Growth: Accumulates savings that you can borrow against or withdraw.

- Fixed Premiums: Premiums generally remain constant throughout your life.

Drawbacks of Whole Life Insurance

- Higher Premiums: The cost is significantly higher than term life, which can be prohibitive for some.

- Complexity: The cash value component and potential dividends can make the product more difficult to understand.