Filing an insurance claim can be a daunting task, especially when you’re dealing with stressful situations like accidents, health issues, or home damages. But knowing how to file an insurance claim quickly and effectively is crucial to getting the compensation you need, when you need it most. This guide will walk you through every step of the process, helping you navigate potential hurdles while ensuring that your claim is processed as swiftly as possible.

What is an Insurance Claim?

At its core, an insurance claim is a formal request made by a policyholder to their insurance company asking for payment based on the terms of the insurance policy. When an insured event occurs, such as a car accident, house fire, or medical emergency, the policyholder files a claim to cover expenses related to damages or losses. Insurance claims are essential for protecting you from financial burdens during unexpected events.

Why Speed Matters in Insurance Claims

Filing your insurance claim quickly is important for several reasons. For one, many policies have strict time limits, meaning that delaying your claim could result in denial. Moreover, the faster you file, the sooner you can receive compensation, which is critical in situations where you need immediate repairs, treatments, or replacements. Insurance companies also process claims in order of submission, so being prompt can help you get to the front of the queue.

Filing promptly ensures you don’t forget critical details or lose important documentation, which could otherwise jeopardize your claim. Acting quickly and having the right strategy can significantly improve the chances of your claim being settled swiftly.

Types of Insurance Claims

Insurance claims come in many forms, each depending on the type of coverage you have. Some of the most common types include:

- Auto Insurance Claims: These are filed after a vehicle accident, theft, or damage.

- Health Insurance Claims: Filed for medical treatment or hospital stays that are covered under a health insurance plan.

- Home Insurance Claims: Filed when your home or personal belongings are damaged by fire, storms, theft, or other covered events.

- Life Insurance Claims: Filed by beneficiaries after the policyholder’s death to receive death benefits.

Each type of claim may have different procedures, so it’s essential to know your specific policy and what it covers.

Gather Essential Documents

When you’re preparing to file a claim, having all the necessary documentation on hand is crucial to avoid delays. Some of the most common documents required include:

- Policy Information: Keep a copy of your insurance policy handy, as it will contain critical details like your coverage, deductibles, and limits.

- Incident Reports: If applicable, police reports, fire department records, or medical reports can be essential.

- Photos and Videos: Visual evidence of damage or injury is incredibly useful in supporting your claim.

- Receipts or Invoices: If you’ve made any payments for repairs or medical bills, keep those records to show expenses.

Without proper documentation, your insurer may delay or deny your claim, so gathering everything in advance is an essential step.

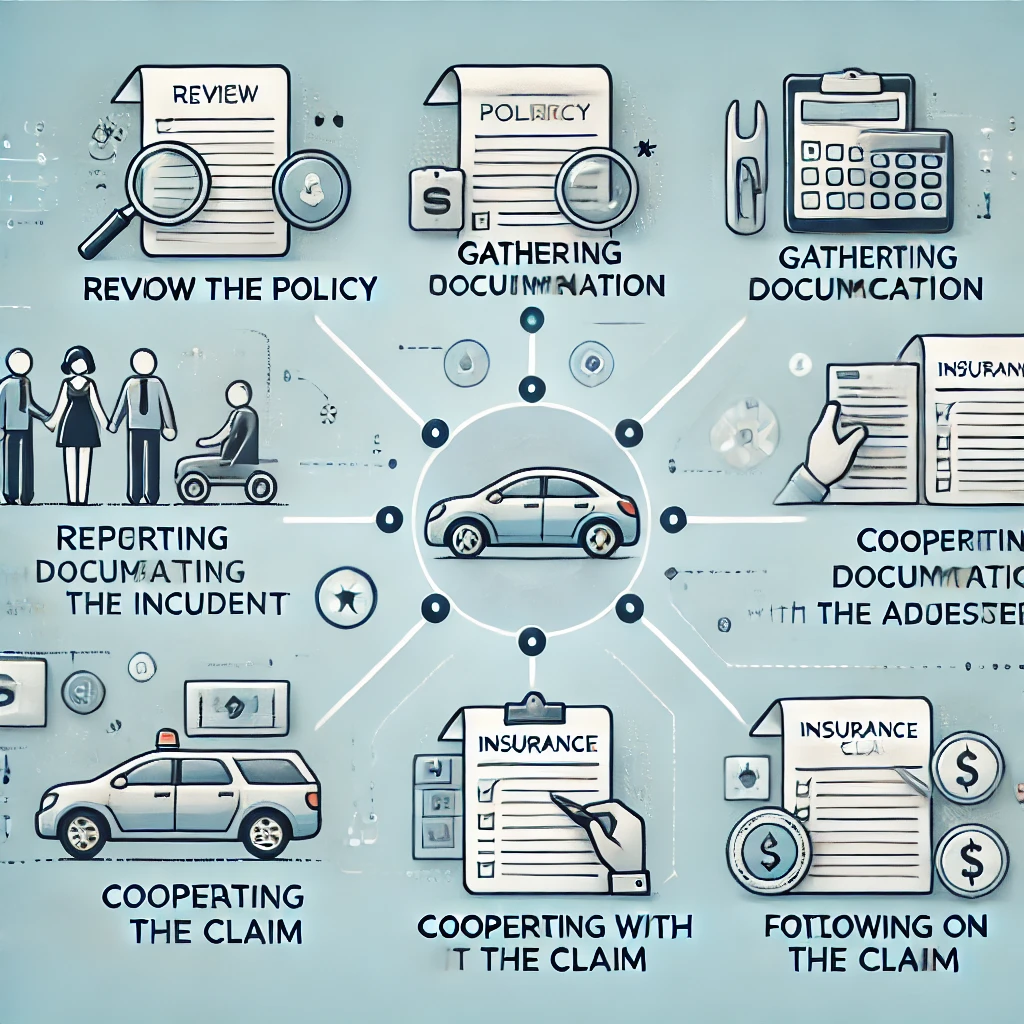

Step-by-Step Guide to Filing an Insurance Claim

- Review Your Insurance Policy: Before anything else, make sure you understand your policy, including what is covered and any limitations or deductibles.

- Report the Incident Immediately: Contact your insurance company as soon as possible. Most insurers have a 24/7 hotline for emergencies.

- Provide Complete Information: Be ready to explain what happened, when it occurred, and provide necessary documentation.

- Cooperate with the Adjuster: The insurance adjuster will investigate the claim, so make sure to provide all required information and access.

- Stay in Touch: Follow up regularly to keep track of your claim’s progress.

- Review the Settlement Offer: Once a settlement offer is made, carefully review it and negotiate if necessary.

Following these steps methodically will help speed up the process while ensuring you don’t overlook any key steps.

Understanding Your Insurance Policy

It may sound basic, but understanding your insurance policy is one of the most important steps in the claims process. Your policy details the scope of your coverage, including the types of incidents covered, limits of your coverage, deductibles, and what is required of you when filing a claim. Knowing these details will not only help you file a claim properly but will also prevent surprises down the road, such as discovering that something you assumed was covered is not.

Preparing for the Initial Contact

Before you call your insurance company, make sure you have all the relevant information on hand. This includes:

- Your insurance policy number

- Date and time of the incident

- A brief description of what happened

- Any police or incident reports, if applicable

- Contact details of any other involved parties, such as drivers or property owners

This preparation will help the call go smoothly and ensure that you provide accurate and complete information from the start.

Contacting Your Insurance Company

Once you have all your information, it’s time to contact your insurance provider. Many companies now offer the ability to file claims online, which can significantly speed up the process. However, if you’re dealing with a complex claim or prefer a more personal approach, you can call your insurance representative directly. Be polite and cooperative during this conversation, as a good rapport can sometimes expedite the claims process.

The Role of Adjusters

An insurance adjuster is a representative of the insurance company responsible for investigating and assessing the damage or loss. The adjuster may visit the site of the incident, interview involved parties, and gather evidence such as photos or statements. The adjuster’s role is crucial, as their assessment determines the settlement amount.

To facilitate the adjuster’s work, make sure you provide clear, complete, and honest information. Cooperating fully can help expedite the investigation, allowing you to receive a settlement faster.

You can also read; How to Compare Life Insurance Policies for Maximum Coverage

How to Follow Up on Your Claim

Once your claim has been filed and the investigation is underway, it’s essential to stay in touch with your insurance company. Following up regularly allows you to check on the progress of your claim and address any issues or delays that may arise. While insurance companies typically provide updates, proactive communication can help you stay on top of things and ensure a quicker resolution.