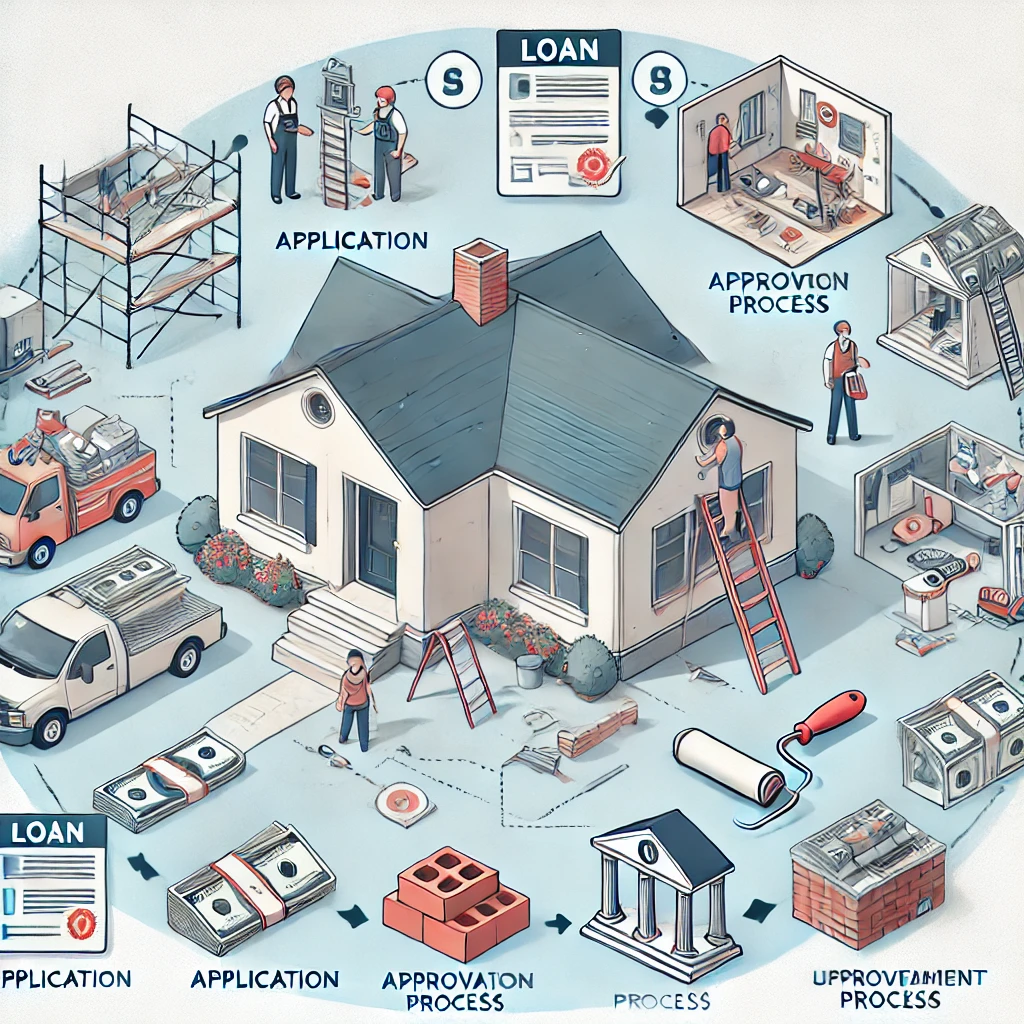

Home renovations can transform your living space and increase the value of your property. But without proper financial planning, the costs can quickly spiral out of control. If you’re wondering how to use a loan to finance your home renovation, you’re not alone. Many homeowners seek loans to cover the expenses of remodeling kitchens, upgrading bathrooms, or building extensions. This guide will take you through everything you need to know about using loans for home renovations and how to choose the best financing option for your needs.

Understanding a Home Renovation Loan

A home renovation loan is a type of financing specifically designed to cover home improvement costs. Whether you’re looking to make small upgrades or embark on a major overhaul, a renovation loan can provide the necessary capital without depleting your savings. Different types of loans, such as personal loans, home equity loans, and government-backed programs, offer various terms, interest rates, and requirements, making it important to understand which one suits your renovation project.

Types of Loans Available for Home Renovation

There are several options available when it comes to financing your home renovation. Each loan type has unique benefits and drawbacks that you’ll need to consider based on your financial situation and the scope of your project.

Home Equity Loan

A home equity loan allows you to borrow against the equity you’ve built in your home. This option provides a lump sum of cash, which you repay in fixed monthly installments over a set period. The interest rates are generally lower than unsecured loans because the loan is secured by your property.

Home Equity Line of Credit (HELOC)

A HELOC offers flexibility in financing. Unlike a home equity loan, a HELOC allows you to borrow money as needed, up to a set limit, making it ideal for long-term or phased renovation projects. Interest is only charged on the amount you borrow, and rates are typically lower than personal loans.

Personal Loan

For those who don’t want to use their home as collateral, a personal loan could be a viable option. These loans are unsecured, meaning they don’t require you to pledge your home as security. However, interest rates may be higher than secured loans, and borrowing limits could be lower.

FHA 203(k) Loan

An FHA 203(k) loan is a government-backed mortgage that allows you to borrow money for home purchases and renovations. It’s a popular choice for people buying fixer-uppers or homes in need of extensive renovations. This loan combines your home purchase and renovation costs into a single mortgage.

Cash-Out Refinance

This loan option allows you to refinance your existing mortgage and withdraw cash for renovations. You’ll take out a new mortgage for a higher amount than what you currently owe, and the difference is given to you in cash. This is a good option if current interest rates are lower than your existing mortgage rate.

How to Choose the Right Loan for Your Renovation

Choosing the right loan to finance your home renovation depends on several factors, including the size of your project, your financial situation, and how quickly you need the money. Here’s how to decide which option might work best for you.

Consider the Scope of Your Project

For smaller projects like painting, flooring, or minor bathroom upgrades, a personal loan or HELOC may be sufficient. However, if you’re planning an extensive renovation, such as building an addition or remodeling multiple rooms, a home equity loan or FHA 203(k) loan might be more appropriate.

Assess Your Financial Situation

Take stock of your current financial standing before taking out a loan. If you have significant equity in your home, a home equity loan or HELOC can provide favorable terms. If you prefer not to use your home as collateral, a personal loan could be your best bet, albeit at a higher interest rate.

Evaluate Interest Rates

Interest rates play a crucial role in determining the overall cost of your loan. Home equity loans and HELOCs typically offer lower interest rates compared to personal loans, but remember that they use your home as collateral. If you can qualify for an FHA 203(k) loan, you might also benefit from lower interest rates due to government backing.

Factor in Loan Terms

Loan terms, such as repayment length and fees, also matter when selecting the best loan. A longer repayment period might make your monthly payments more manageable, but it could increase the total interest paid over the life of the loan. Be sure to read the fine print and understand any fees associated with the loan, such as origination fees, closing costs, or prepayment penalties.

Benefits of Financing Your Home Renovation with a Loan

Using a loan to finance your home renovation offers several advantages, especially when managed responsibly. Here are some of the key benefits:

Immediate Access to Funds

One of the biggest advantages of taking out a loan is the immediate access to funds, allowing you to start your renovation project without delay. This can be especially important for urgent repairs or improvements that increase the comfort and functionality of your home.

Preserve Savings

A loan allows you to undertake significant home improvements without dipping into your savings. Instead of liquidating investments or depleting emergency funds, you can spread the cost of the renovation over time, making it more financially manageable.

Increase Home Value

Home renovations can substantially increase the value of your property, making it a worthwhile investment. Strategic upgrades, such as kitchen remodels or energy-efficient improvements, can provide a high return on investment (ROI) and may even boost your home’s resale value beyond the cost of the loan.

Tax Benefits

Depending on the loan type and how the funds are used, you might be able to deduct the interest paid on a home equity loan or HELOC from your taxes. Always consult with a tax professional to understand the implications of your renovation financing.

Common Mistakes to Avoid When Financing Your Renovation

While loans can be an excellent way to finance home renovations, there are pitfalls to watch out for. Avoid these common mistakes to ensure you make the most of your loan.

Overborrowing

It’s tempting to take out a larger loan than you need, especially if you qualify for a significant amount. However, overborrowing can lead to financial strain down the road, especially if your monthly payments stretch your budget.

Not Considering All Costs

Be sure to account for all the costs associated with your renovation, including labor, materials, permits, and unexpected expenses. Many homeowners underestimate the true cost of a project, leading to budget shortfalls and the need for additional financing.

Ignoring Loan Terms

It’s essential to fully understand the terms of your loan, including the interest rate, repayment schedule, and any fees. Failing to grasp these details can result in higher-than-expected costs or penalties if you miss a payment or pay off the loan early.

You can also read; How to Compare Loan Offers and Find the Best Deal

Failing to Shop Around

Not all loans are created equal, so it’s vital to shop around for the best rates and terms. Compare offers from different lenders, including banks, credit unions, and online lenders, to ensure you’re getting the most favorable deal.t savings.