Recent Posts

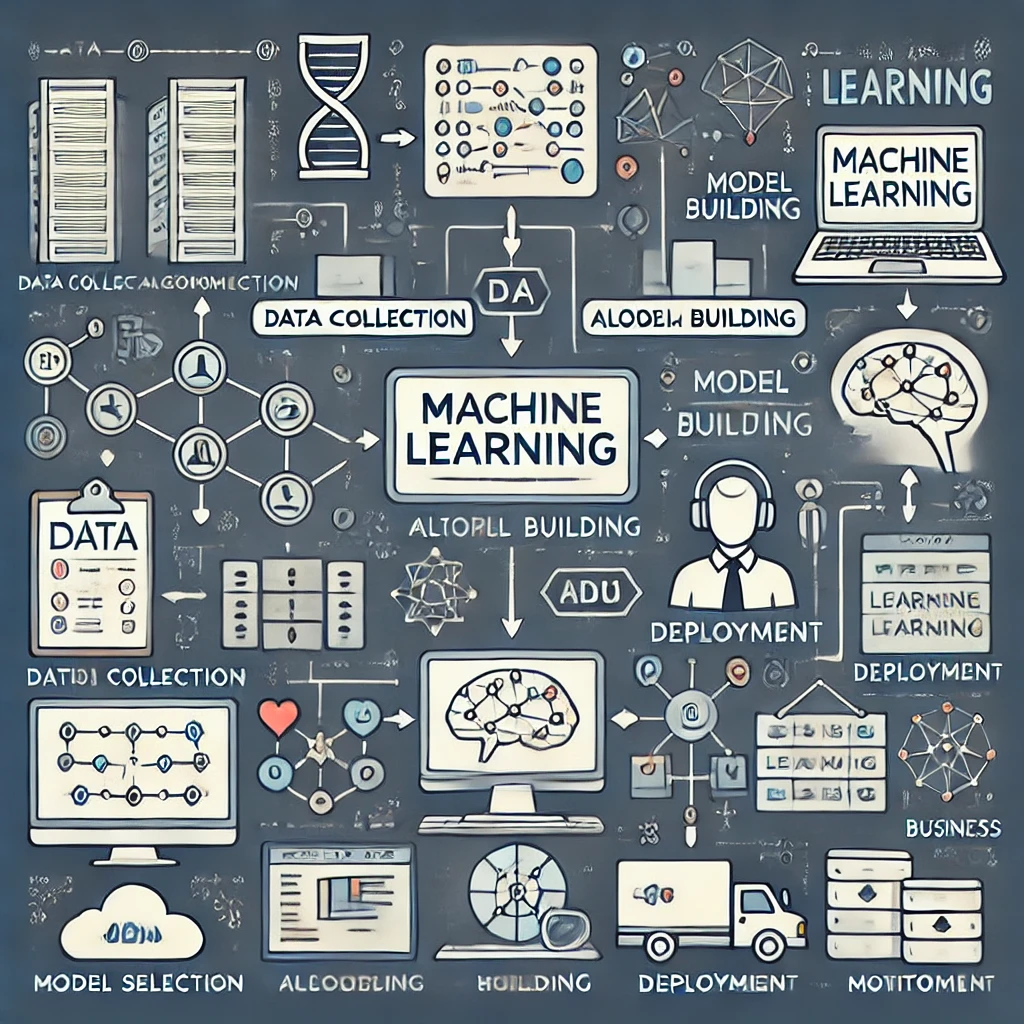

How to Implement Machine Learning in Real-World Projects

In today’s data-driven world, machine learning (ML) has moved from an academic concept to a game-changer for businesses across various industries. Companies are leveraging machine…

How to Implement Machine Learning in Real-World Projects

Introduction In the digital age, where data is the new oil, machine learning has emerged as a critical tool for businesses and industries to solve…

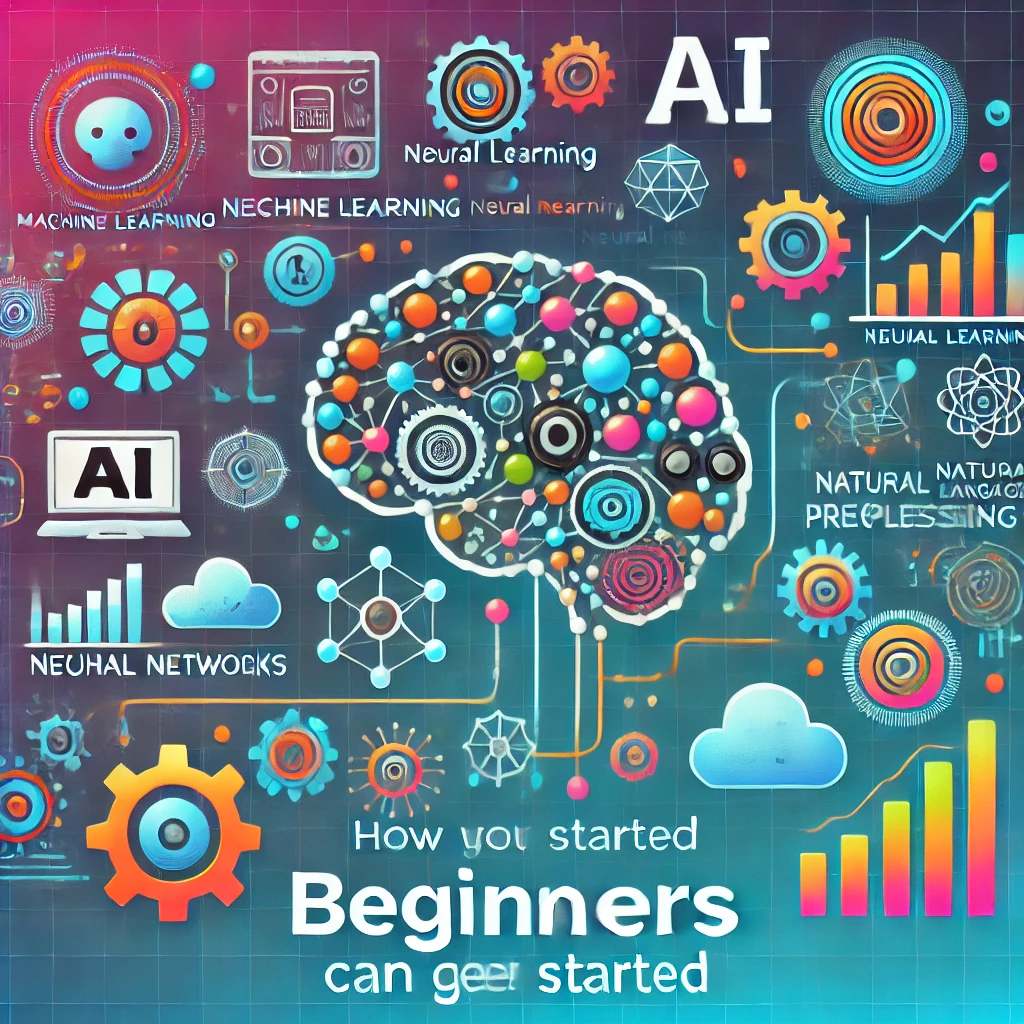

How to Get Started with Artificial Intelligence for Beginners: A Comprehensive Guide

Artificial Intelligence (AI) has become a transformative force across industries, from healthcare to finance to entertainment. But how can someone with little to no experience…

How to Avoid Predatory Lending and Unfavorable Loan Terms

Navigating the world of loans can be tricky. One wrong move, and you might find yourself caught in a web of predatory lending practices, where…

How to Use a Personal Loan for Debt Consolidation Effectively

Consolidating debt with a personal loan can be an excellent strategy to simplify your finances, reduce stress, and potentially save money. But if not approached…

How to Understand Loan Terms and Conditions Before You Sign

Loan terms and conditions are the legally binding rules that govern the loan agreement between you and the lender. These terms outline your obligations, the…

How to Lower Your Loan EMIs (Equated Monthly Installments)

In today’s fast-paced financial environment, managing debt is crucial to maintaining personal economic stability. Equated Monthly Installments (EMIs) can often be overwhelming, especially when they…

How to Choose Between a Secured and Unsecured Loan

When it comes to borrowing money, one of the most important decisions you’ll face is choosing between a secured loan and an unsecured loan. Both…

How to Get a Loan with No Credit History

Securing a loan without a credit history may seem impossible, but with the right strategies, it is entirely achievable. If you are new to credit…

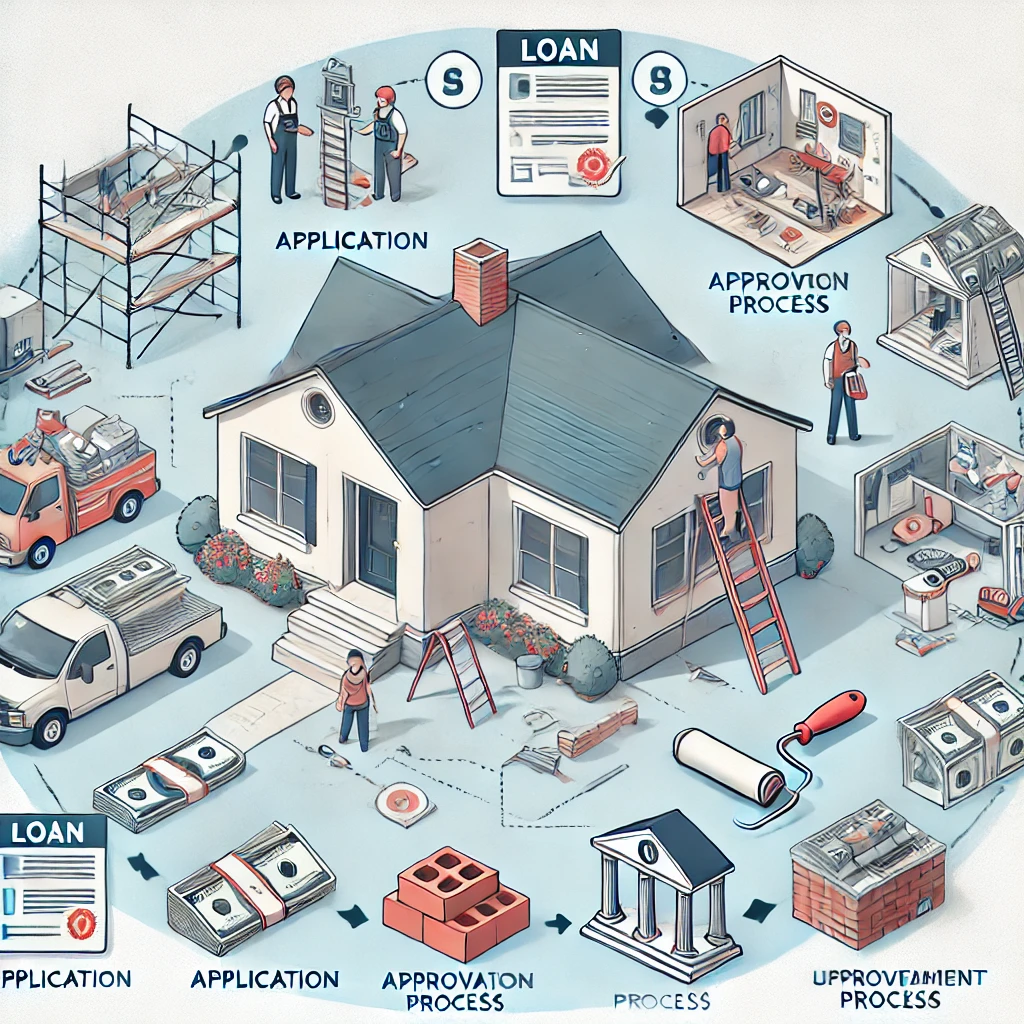

How to Use a Loan to Finance Your Home Renovation

Home renovations can transform your living space and increase the value of your property. But without proper financial planning, the costs can quickly spiral out…